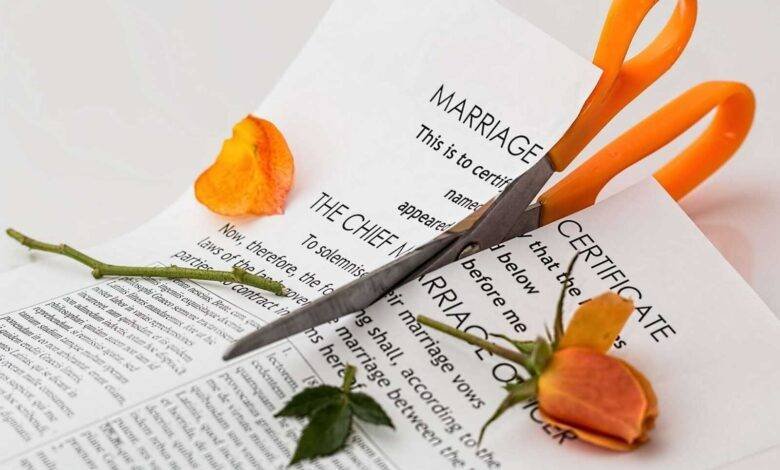

Financial Independence After Divorce: 14 Steps to Reclaim Your Future

Table of Contents

Divorce or the end of a significant relationship can bring about significant financial changes and challenges, especially for women. However, it’s also an opportunity for growth, empowerment, and reclaiming control over one’s financial future. In this comprehensive guide, we’ll delve into various aspects of achieving financial independence after divorce or breakup, providing detailed information, practical tips, and valuable resources to empower women on their journey toward financial security and success.

Going through a divorce or breakup often marks the beginning of a new chapter in a woman’s life, including financial independence. Here’s a breakdown of key steps to achieve financial autonomy post-divorce:

Financial Independence after Divorce: Rebuilding Credit

Divorce can have a significant impact on credit scores, particularly if joint accounts are involved. Rebuilding credit involves obtaining a copy of your credit report, addressing any outstanding debts, and making timely payments. Opening new lines of credit and maintaining a positive payment history can also help improve credit scores over time.

Example Resource: AnnualCreditReport.com provides free credit reports from the three major credit bureaus, allowing individuals to monitor their credit history.

Financial Independence after Divorce: Dividing Assets

Dividing assets during divorce proceedings requires careful consideration and often involves negotiations between spouses or legal representatives. It’s crucial to understand the marital property laws in your state and work with legal professionals to ensure a fair division of assets. Documenting all assets and liabilities can facilitate this process and ensure transparency.

Example Resource: LegalZoom offers online legal services and resources, including guides on asset division during divorce.

Financial Planning After Divorce for Single Moms

Financial planning becomes paramount for single mothers post-divorce as they navigate the challenges of managing household finances independently. Creating a budget, establishing an emergency fund, and exploring additional income opportunities are essential steps. Single moms may also benefit from seeking child support and government assistance programs to alleviate financial burdens.

Example Resource: Single Mother Assistance provides information on government benefits and resources available to single mothers, including financial assistance programs.

Best Investments for Divorced Women

Choosing the right investments post-divorce is crucial for building long-term financial security. Diversifying investment portfolios with a mix of stocks, bonds, real estate, and retirement accounts can help mitigate risk and optimize returns over time. Consulting with a financial advisor can provide personalized investment recommendations based on individual financial goals and risk tolerance.

Example Resource: Vanguard offers investment products and resources for individual investors, including retirement planning tools and educational materials.

Retirement Savings After Divorce

Maintaining retirement savings is essential for securing financial stability in the long run. Women should review and update beneficiary designations on retirement accounts, maximize contributions to employer-sponsored retirement plans, and consider opening individual retirement accounts (IRAs) for additional savings. Planning for retirement early and consistently contributing to retirement accounts can help women achieve their retirement goals.

Example Resource: Retirement Planning Calculator helps individuals estimate their retirement savings needs based on factors such as age, income, and desired retirement age.

How to Get Alimony for Women

Alimony, also known as spousal support, may be awarded to women post-divorce to help maintain their standard of living. Eligibility for alimony depends on various factors, including the duration of the marriage, income disparity between spouses, and individual financial needs. Women should consult with family law attorneys to understand their rights and options regarding alimony and negotiate terms that align with their financial needs.

Example Resource: Avvo provides legal information and resources, including directories of family law attorneys specializing in divorce and alimony cases.

Child Support and Financial Independence

Child support can play a significant role in providing financial stability for single mothers post-divorce. Understanding child support guidelines and working with legal professionals to establish fair and reasonable support arrangements is essential. Single mothers should budget accordingly to cover child-related expenses and plan for their children’s future financial needs, such as education and extracurricular activities.

Example Resource: Child Support Calculator helps estimate child support payments based on state guidelines and individual circumstances.

Affordable Divorce Lawyers for Women

Finding affordable legal representation is critical for women navigating divorce, especially those facing financial constraints. Researching local resources, such as legal aid organizations and pro bono services, can help women access legal assistance without incurring excessive costs. It’s essential to prioritize finding competent and experienced attorneys who can effectively advocate for women’s rights and interests throughout the divorce process.

Example Resource: Legal Services Corporation provides legal aid to low-income individuals facing civil legal issues, including divorce and family law matters.

Starting Over Financially After Divorce

Starting over financially post-divorce requires resilience, determination, and proactive planning. Women should focus on rebuilding their financial foundation by setting realistic goals, developing a budget, and identifying opportunities for income growth and wealth accumulation. Seeking support from family, friends, and financial professionals can provide valuable guidance and encouragement during this transitional period.

Example Resource: Financial Planning Association offers a directory of certified financial planners who can provide personalized financial guidance and support.

Budgeting and Saving After Divorce

Creating a budget is essential for managing finances effectively post-divorce. Women should track their income and expenses carefully, identify areas where they can reduce costs, and prioritize saving for emergencies, retirement, and future financial goals. Implementing budgeting tools and apps can streamline the budgeting process and help women stay on track with their financial objectives.

Example Resource: Mint is a popular budgeting app that allows users to track their spending, set financial goals, and monitor their overall financial health.

Emotional and Financial Independence After Divorce

Achieving emotional and financial independence after divorce is a transformative journey that requires self-reflection, self-care, and personal growth. Women should focus on healing from past traumas, building self-esteem, and embracing their newfound freedom and autonomy. Seeking support from therapists, support groups, and mentors can provide emotional validation and encouragement as women navigate this journey of self-discovery and empowerment.

Example Resource: DivorceCare offers support groups and resources for individuals coping with separation and divorce, including emotional and spiritual guidance.

Building a Support Network After Divorce

Building a strong support network is crucial for women post-divorce, providing emotional validation, practical assistance, and encouragement during challenging times. Women should seek out support groups, therapy, and community resources to connect with others who have shared experiences and can offer empathy and understanding. Cultivating meaningful relationships with friends, family, and mentors can provide a sense of belonging and empowerment as women rebuild their lives post-divorce.

Example Resource: Meetup offers online and in-person support groups for individuals facing various life challenges, including divorce and relationship transitions.

Investing for Single Women Over 50

Investing for women over 50 requires careful consideration of financial goals, risk tolerance, and time horizon. Women in this demographic should focus on preserving capital, generating income, and managing risk effectively. Investing in diversified portfolios, including stocks, bonds, and real estate, can provide opportunities for wealth preservation and growth in retirement. Consulting with financial advisors and retirement planners can help women make informed investment decisions aligned with their long-term financial objectives.

Example Resource: AARP offers investment resources and retirement planning tools specifically designed for individuals aged 50 and older.

Rebuilding Wealth After Divorce

Rebuilding wealth post-divorce requires strategic planning and disciplined execution. Women should set clear financial goals, develop a comprehensive financial plan, and leverage opportunities for income growth and wealth accumulation. Seeking professional advice from financial planners and advisors can help women navigate this process effectively.

Example Resource: XY Planning Network connects individuals with fee-only financial advisors who specialize in serving women and other underserved demographics.

In conclusion, achieving financial independence after divorce or breakup is a journey that requires resilience, determination, and careful planning. By taking proactive steps to rebuild their financial lives, women can reclaim control and secure their future. Remember, you are not alone on this journey. Reach out to trusted professionals and support networks for guidance and encouragement. Together, we can empower women to thrive financially and live life on their own terms.

Frequently Asked Questions

Q1: How can I rebuild my credit after a divorce?

A: Discover practical steps to improve your credit score and regain financial stability post-divorce.

Q2: What investments are suitable for women starting over financially?

A: Explore diversified investment options tailored to women rebuilding wealth after life-changing events.

Q3: Is alimony guaranteed after divorce, and how can I secure it?

A: Learn about alimony eligibility, negotiation strategies, and securing financial support after divorce.

Q4: How do I navigate child support for financial independence?

A: Understand child support guidelines and strategies for managing finances as a single parent.

Q5: Where can I find affordable divorce lawyers who prioritize women’s rights?

A: Access resources to connect with competent and affordable legal professionals who champion women’s rights.

Q6: What emotional and financial support is available post-divorce?

A: Explore avenues for emotional healing, empowerment, and building a supportive network after divorce.

Q7: Are there investment options tailored for single women over 50?

A: Gain insights into investment strategies designed for financial security during the golden years.

Q8: How can I start budgeting and saving effectively after a divorce?

A: Discover practical budgeting tips and tools to navigate financial independence with confidence.

Q9: What resources help women overcome financial anxiety post-divorce?

A: Access resources and strategies to overcome financial stress and anxiety on your journey to independence.

Q10: Where can I find relevant workshops and communities for financial literacy?

A: Explore workshops and communities offering financial education and support tailored to women’s needs.