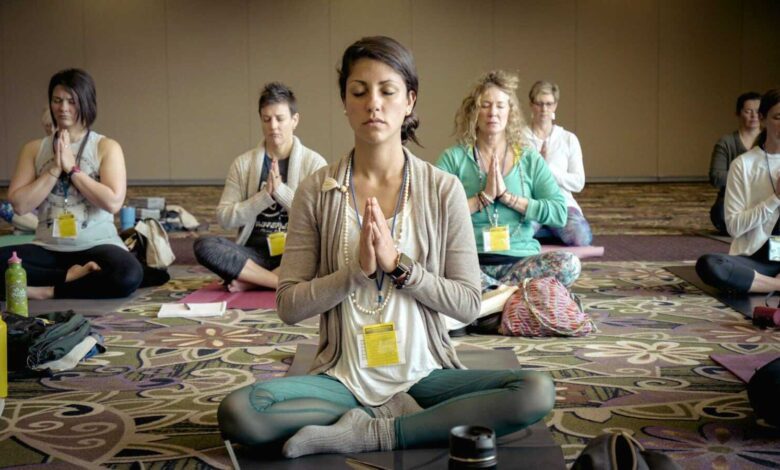

Financial Yoga: 7 Poses for Financial Freedom (US Women)

In today’s fast-paced world, managing finances can often feel like a daunting task. From paying bills to saving for the future, the demands of financial responsibility can sometimes overshadow the enjoyment of life’s experiences. However, adopting a mindful approach to money management can transform your relationship with finances and pave the way for a more balanced and fulfilling life. This concept, often referred to as “financial yoga,” integrates principles of mindfulness, intentionality, and self-awareness into the realm of personal finance. In this article, we will explore the essence of financial yoga, its key components, and how you can apply it to create a harmonious and purpose-driven money journey.

Table of Contents

Understanding Financial Yoga

Financial yoga is not just about crunching numbers or sticking to a budget; it’s about cultivating a holistic approach to money management that aligns with your values, goals, and overall well-being. Similar to the practice of yoga, which focuses on physical, mental, and spiritual alignment, financial yoga encourages individuals to approach their finances with mindfulness and intentionality.

At its core, financial yoga emphasizes the importance of finding balance between financial responsibility and enjoyment. It recognizes that money is not just a means of exchange but a tool for creating a life of abundance, purpose, and fulfillment. By integrating mindfulness practices into your financial decisions, you can cultivate a deeper understanding of your relationship with money and make choices that support your overall well-being.

The Components of Financial Yoga

Financial yoga encompasses various components that contribute to its holistic approach to money management. These include:

Mindful Budgeting:

Practicing mindful budgeting involves being conscious of where your money is going and aligning your spending with your values and priorities. By tracking your expenses and making intentional choices about how you allocate your resources, you can ensure that your financial decisions are in line with your long-term goals.

Balancing Financial Responsibilities and Enjoyment:

One of the key principles of financial yoga is finding the right balance between meeting your financial obligations and enjoying life’s experiences. While it’s essential to save for the future and plan for emergencies, it’s equally important to allocate resources for activities and experiences that bring you joy and fulfillment.

Creating a Meaningful Money Journey:

Financial yoga encourages individuals to view their financial journey as more than just a series of transactions; it’s an opportunity for personal growth, self-discovery, and empowerment. By approaching your finances with a sense of purpose and intention, you can create a meaningful money journey that aligns with your values and aspirations.

Overcoming Guilt and Shame Around Spending:

Many people struggle with feelings of guilt or shame when it comes to spending money on themselves or others. Financial yoga encourages individuals to cultivate a healthy relationship with money by letting go of negative emotions and embracing a mindset of abundance and gratitude.

Financial Wellness and Self-Care:

Just as physical and mental wellness are essential for overall well-being, financial wellness is a crucial aspect of self-care. Financial yoga emphasizes the importance of taking care of your financial health by prioritizing activities and practices that support your financial well-being.

Build a Healthy Relationship with Money:

At the heart of financial yoga is the idea of building a positive and empowering relationship with money. This involves developing an understanding of your financial beliefs, habits, and attitudes and making conscious choices that support your financial goals and values.

Practical Tips for Practicing Financial Yoga

Now that we’ve explored the principles of financial yoga let’s discuss some practical tips for incorporating this approach into your daily life:

- Set Intentions: Start by setting clear intentions for your financial journey. Define your goals, values, and priorities, and use them as a guide for your financial decisions.

- Practice Mindful Spending: Before making a purchase, take a moment to pause and consider whether it aligns with your values and priorities. Ask yourself if the item or experience will bring you true satisfaction and fulfillment in the long run.

- Track Your Expenses: Keep track of your spending habits by using a budgeting app or journal. Review your expenses regularly to identify areas where you can cut back or reallocate resources.

- Find Joy in Saving: Rather than viewing saving as a sacrifice, reframe it as an investment in your future happiness and well-being. Celebrate small victories along the way and acknowledge the progress you’ve made toward your financial goals.

- Practice Gratitude: Cultivate a sense of gratitude for the resources you have and the opportunities available to you. Take time each day to reflect on the abundance in your life and express appreciation for the financial blessings you’ve received.

- Set Boundaries: Establish boundaries around your finances to prevent overspending and impulse purchases. Learn to say no to unnecessary expenses that do not align with your goals or values.

- Seek Support: Don’t be afraid to seek support from friends, family, or financial professionals when needed. Surround yourself with people who encourage and support your financial journey.

- Embrace Imperfection: Understand that financial yoga, like any practice, is not about perfection but progress. Allow yourself grace and compassion as you navigate the ups and downs of your financial journey.

Learning from Successful Women in Finance

Many successful women in finance have embraced the principles of financial yoga and incorporated them into their lives and careers. Let’s take a look at some examples:

- Catherine Wood (ARK Invest): As the CEO and founder of ARK Invest, Catherine Wood is known for her innovative approach to investing and her commitment to conscious consumerism. She believes in investing in disruptive technologies that have the potential to create positive change in the world.

- Sallie Krawcheck (Ellevest): Sallie Krawcheck is the founder and CEO of Ellevest, a digital investment platform designed specifically for women. She is a strong advocate for financial literacy and empowerment and believes in helping women take control of their financial futures.

- Paula Pant (Afford Anything): Paula Pant is the author of the popular personal finance blog Afford Anything, where she shares her journey to financial independence and encourages others to design a life they love. She believes in the power of mindful budgeting and intentional living to create financial freedom.

- Michelle Singletary (Washington Post): Michelle Singletary is a nationally syndicated personal finance columnist for The Washington Post. She is known for her no-nonsense approach to money management and her emphasis on living within your means and avoiding debt.

- Erin Lowry (Broke Millennial): Erin Lowry is the author of the bestselling book “Broke Millennial” and the founder of the Broke Millennial blog. She is passionate about helping young adults navigate the complexities of personal finance and make smart financial decisions.

- Tori Dunlap (Her First $100k): Tori Dunlap is the founder of Her First $100k, a platform dedicated to helping women achieve financial independence. She is a firm believer in the power of financial education and empowerment to change lives.

- Natoya Lynch (She’s Got Cents): Natoya Lynch is the founder of She’s Got Cents, a blog and platform focused on financial education for women of color. She is dedicated to breaking down barriers to financial success and empowering women to take control of their finances.

- Bola Sokunbi (Clever Girl Finance): Bola Sokunbi is the founder of Clever Girl Finance, a platform that provides financial education and resources for women. She is passionate about helping women build wealth and achieve financial independence.

Resources for Your Financial Yoga Journey

As you embark on your financial yoga journey, there are many resources available to support you along the way. Here are a few worth exploring:

- Websites: Ellevest, Broke Millennial, Clever Girl Finance, Afford Anything, Her First $100k, She’s Got Cents.

- Books: “Financial Freedom with Purpose” by Natalie Baccus, “Afford Anything” by Paula Pant, “The Latte Factor” by David Bach, “Broke Millennial Takes on Investing” by Erin Lowry.

- Podcasts: Afford Anything with Paula Pant, Her First $100k with Tori Dunlap, She’s Got Cents with Natoya Lynch.

In conclusion, financial yoga offers a transformative approach to money management that prioritizes mindfulness, intentionality, and self-awareness. By integrating the principles of financial yoga into your life, you can cultivate a deeper understanding of your relationship with money and create a more balanced and fulfilling money journey. Whether you’re budgeting, saving, or investing, practicing financial yoga can help you align your financial decisions with your values and goals, leading to greater peace of mind and overall well-being.

FAQ:

- What is financial yoga, and how does it differ from traditional money management?

Financial yoga combines principles of mindfulness and intentionality with personal finance to create a holistic approach to money management. Unlike traditional methods, which focus solely on budgeting and saving, financial yoga emphasizes the importance of aligning your financial decisions with your values and priorities. - How can I practice financial yoga in my daily life?

You can practice financial yoga by setting clear intentions for your financial journey, practicing mindful spending, tracking your expenses, and cultivating a sense of gratitude for your financial blessings. - What are some common challenges people face when practicing financial yoga?

Some common challenges include overcoming feelings of guilt or shame around spending, finding balance between financial responsibilities and enjoyment, and managing financial stress and anxiety. - Can anyone practice financial yoga, or is it only for experienced yogis?

Financial yoga is accessible to anyone, regardless of their level of experience with yoga or personal finance. It’s about cultivating a mindful and intentional approach to money management that aligns with your values and goals. - How can I learn more about financial yoga and connect with others who practice it?

You can learn more about financial yoga by exploring resources such as books, websites, and podcasts dedicated to personal finance and mindfulness. You can also connect with like-minded individuals through online communities and social media platforms. - What are some practical tips for incorporating financial yoga into my daily routine?

Some practical tips include setting clear intentions for your financial goals, practicing gratitude for your financial blessings, and seeking support from friends, family, or financial professionals when needed. - Is financial yoga only about saving money, or does it also involve investing and spending?

Financial yoga encompasses all aspects of money management, including saving, investing, and spending. It’s about making conscious choices that support your overall financial well-being and align with your values and goals. - How can I overcome feelings of guilt or shame around my financial decisions?

You can overcome feelings of guilt or shame by practicing self-compassion, reframing negative thoughts, and focusing on the positive aspects of your financial journey. Remember that everyone makes mistakes, and it’s important to learn from them and move forward with kindness and understanding. - What role does gratitude play in financial yoga?

Gratitude plays a significant role in financial yoga by helping you cultivate a positive mindset and appreciation for your financial blessings. By practicing gratitude, you can shift your focus from scarcity to abundance and create a more fulfilling relationship with money. - How can financial yoga help me achieve my long-term financial goals?

Financial yoga can help you achieve your long-term financial goals by providing you with a framework for making intentional and mindful financial decisions. By aligning your actions with your values and priorities, you can create a path to financial success and fulfillment.